By Tadeus Dobrovolskij

No matter if we are talking about cash or your employees’ capacity to handle work – resources are not limitless, and it is important to prioritize and make smart choices. However, this is not as straightforward as it sounds. In our experience, many companies struggle with making a choice: they undertake too many projects at the same time, they spend money and time on different transformation initiatives and keep assigning tasks to their teams ignoring declines of productivity and morale. No company can do everything and the ones that try usually water down their strategic positioning and end up behind their competition.

Prioritization and making choices are vital for long-term success. In this short article we discuss common mistakes and the best general approach in this area. We focus on prioritizing projects/initiatives, as other types of choices (like task delegation to your employees) require a completely different framework.

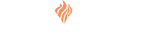

Be it a choice of a location for a new product launch, or a choice of a transformational initiative to start, when it comes to a general approach, it is best to evaluate each option on three dimensions: strategy, operations, and finance. This is intuitively understandable to many, although, most often companies get the order wrong – wasting time and resources.

Priority #1 – strategic evaluation

Strategy is important. Despite being a relatively new concept in the business world (dating back to the 1960s), nowadays no one disputes the vitality of a good strategy anymore. As we have discussed in another article already, companies with a clearly defined strategy deliver, on average, 15 times greater returns to shareholders, significantly outdoing less prepared peers.

Yet, companies rarely evaluate whether their new initiative/project aligns with their strategy. Such misalignment costs billions of dollars every year – billions that could be spent on more promising endeavors or returned to shareholders. Considering that 97% of executives believe that strategic leadership (which includes systemic thinking and prioritizing) is most critical to their companies’ success, it is surprising that only 32% of businesses have processes in place for project evaluation.

At the initial stage, management needs to evaluate whether a new initiative advances the company’s strategy, but it also needs to ensure an ongoing evaluation during a project’s lifetime – using a set of KPI’s to check that the project is advancing not only financial, but also strategic goals.

The former evaluation is the most crucial, because it saves your company money and human resources. An initiative that does not move a company towards its strategic goals is just a misallocation of company capital that could have been better used on other initiatives that align better with the company’s strategy.

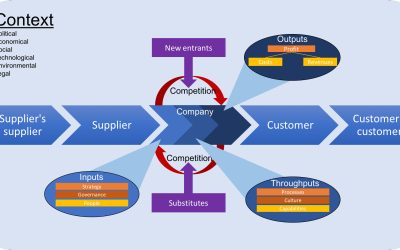

To understand where the new initiative is going to take you, your company needs to analyze its effects on the overall competitive position. What will be competitors’ most likely reaction? Will the change require any modification to your business model? If changes to available resources or operational capabilities are expected, they need to be clearly documented.

If this analysis shows a perfect alignment and you do not expect any major changes, then you are safe to proceed. Yet, safety may also mean that potential gains will be minimal – maybe this initiative is not as promising as you thought initially. Further steps will clarify this fully.

At the other end of the spectrum the analysis could show that there is no alignment between your current strategy and the new initiative. Unless you are an early-stage startup ready to pivot, this means that you should drop the initiative. There is no justification for pursuing something that completely diverges from the existing strategy.

In most cases, however, the analysis will indicate a partial alignment. If you pursue the initiative, it will affect the company’s competitive position in some way, and, as a result, the strategy will need to be updated eventually. Just like with the perfect alignment scenario discussed above, only by evaluating your initiative on the other two dimensions – operational and financial – will you know if it is worth your while. However, potential gains are usually higher in this case than in the perfect alignment scenario – after all, higher risks should bring higher rewards.

To give a practical example we draw on our experience in the UAE. Although the education sector is growing in the Emirates – as you can see in our research – current growth comes mostly from the mid-market segment. Nevertheless, we still see famous global brands opening new schools in the premium segment. Depending on the goal these schools are pursuing, this could either align or misalign with their strategy. In any case, an extensive analysis of the market situation is needed. Companies entering a new market need to understand the market situation, competitive landscape, and evaluate potential risks. Maybe there are alternative options, like acquiring an existing school, or entering different markets that are better aligned with the strategy.

With our clients we would start from a position of caution in such a scenario. As the UAE market matures, quick and easy ways to make money disappear – mature markets require data-driven approach and rigorous analysis. Smart investors know this, and they evaluate their ideas on all three dimensions (starting with the strategic dimension) before committing any funds.

To summarize: if the evaluation on the strategic dimension is done before any other, a company can save resources that it would otherwise spend on a financial evaluation – be it a simple cost-benefit analysis or a more sophisticated NPV calculation – or another type of viability assessment. Unfortunately, many executives start building their business case by evaluating a project on the financial dimension – a dimension that is irrelevant, if there is no strategic alignment.

Next – assess implementation

Almost every company checks whether something is realistic with its current capabilities before trying to implement it. It usually comes as a no-brainer – talk with your COO, or a production manager, or the head of the project management office, and establish a suitable implementation/go-to-market plan.

Normally, this type of assessment should be done during the strategic planning process. Be it a new strategy development, or, as we discussed in the previous chapter – the evaluation of a new initiative. However, strategic planning is a big picture evaluation – going into too much detail is unnecessary in most cases. Strategy can be drawn up with just a broad overview and rough numbers. To prepare the implementation we need to dive deeper and assess capabilities in full, detailing all the steps. Considering that a strategy always needs to be actionable, it is absurd to prepare it without taking into account the process of strategy implementation. Implementation, however, cannot be discussed at all if strategy is still unclear. Operational capabilities always need to match strategic aspirations.

Sometimes a company cannot implement chosen projects/initiatives with its existing capabilities – this is totally normal. Capabilities can be either expanded or borrowed (by means of a business partnership). Because it is unclear initially whether any additional investment is required for a successful implementation, it is imperative to do this type of assessment before trying to conduct any kind of financial viability study. After all, any necessary investment will change your financial models.

In our experience, the main issue that companies stumble upon in this phase is a lack of involvement of key managers and lower level employees. Too often the implementation plan comes as a top-down solution, stifling innovation and ignoring unique insights that only front-line employees possess. By involving your employees, you can uncover new approaches, and develop a more efficient and robust implementation plan.

Listening to front-line employees will not only help to create a winning implementation plan, but also boost morale and reduce employee turnover. As our experience in the US healthcare sector shows, employee turnover is a major obstacle for healthcare providers: the average turnover rate is 19% in the physical health sector, and behavioral health providers face, on average, stunning 40%. Just by incorporating employee surveys into standard processes, hospitals and clinics can gain a significant competitive advantage.

Last but not least – financial modeling

As we mentioned a few times already, businesses tend to assess new projects on the financial dimension and they prioritize this evaluation above others. In our experience, it is done in three ways: 1. How much is the project/initiative going to cost vs. how much money do we have at hand? (Very common approach, especially among smaller businesses) 2. Cost-benefit analysis – assessing potential gains vs. expected expenditures (relatively common, but mostly among medium-sized companies). 3. Net present value (NPV) calculation (rare, usually only carried out by big enterprises).

This leads to two problems at once. First, starting with a financial evaluation may lead to unnecessary work. After all, it is impossible to undertake a good financial assessment of a project without a clear understanding of the entire implementation process. Giving priority to a financial assessment can also lead to a loss of strategic focus, if a company decides to proceed with an initiative that is profitable, but not strategically viable.

Second, carrying out only a very naive assessment (approach #1 mentioned above) does not answer whether an undertaking will bring sufficient returns to cover an investment. Ultimately, entrepreneurial personalities are, in their nature, overly optimistic – reality can be completely different.

Only by building a robust financial model, evaluating expected gains versus expenditures (and, ideally, taking the cost of capital and the time value of money into account), can managers make a truly informed decision.

If you implement these suggestions you will improve not only your company’s decision making, but also financial forecasting, which normally leads to increased company value.

Of course, a financial evaluation might lead to a revision of a company’s strategy. That is normal. Moreover, additional factors might come into play and induce you to start the prioritization process from scratch: a change in the competitive landscape could require a pivot in your company’s strategy. Your empowered team could come up with a ground-breaking idea calling for a shift in your business model. Finally, your company’s size matters as well – smaller companies are allowed to be more opportunistic, which can make the whole evaluation process less straightforward.

If you would like guidance on prioritization, or if you still are unsure whether you are making the right choices – contact us, and we will provide you with tailored assistance.