By Garett Robertson

Recently I was discussing my models of wealth and income inequality with a friend of mine. During the course of our discussion, he asked me the simple question that has some profound implications on everything for economics and politics to religion and philosophy. Why does economic inequality matter? I have always been passionate about this subject as it influences a great deal about my personal beliefs about society and myself. Herein I attempt to convey a portion of my thoughts on the subject. Inequality matters because, if left unattended, if leads to the gradual deterioration of society. If it is addressed however, it can lead to economic growth and opportunity for everyone.

The negative consequences of wealth and income inequality are not hard to see. Greed, Corruption, Division, Violence and Irrational market behavior are all vices that are generated through the mechanisms of growing inequality. The debate over these issues is interesting to me because inevitably, it turns into a debate about why every class of society is not responsible for it. Everyone has a reason why someone or something else is responsible.

There is a good reason for this debate because solutions are not so clear as to readily reveal themselves to the debaters. Can the wealthy be condemned for taking risks and being entrepreneurial? Should those born into circumstances that denied them opportunities for proper education or capital be spurned? Can the government be blamed when the ideas and people were lobbied and elected by the rich and poor? The debate is indeed confusing and complex.

The problem is that inequality is not the result of one person or class. It is a natural consequence of capitalism. As cited in my previous works, the poor are reliant on the wealthy for their daily support. They need food, clothing, shelter, etc. The poor disproportionately make these purchases from those who are wealthier.

At the same time, the wealthy, being good stewards over their assets, are risk averse. They want to invest their capital into things they are sure will grow the asset. This idea creates the outcome wherein the wealthy utilize their resources disproportionately on the wealthy vs. the poor.

These two ideas create a cycle in which wealth inequality forms. While everyone debates how to handle the inequality, the negative consequences of it grow until some kind of critical mass is achieved and rebalancing occurs. Such can be considered the case with the French Revolution or the Great Depression. In the wake of these rebalancing events, the cycle begins again, wealth is redistributed, inequality begins to grow and the debate continues.

These cycles of inequality share a few common characteristics. First, as inequality reaches a tipping point, there is usually social and political unrest as the population’s wealthy buy politics and the poor and other demographics struggle for a voice. This was the hallmark of the French Revolution.

Second there is usually a negative demand shock as low incomes prevent the bottom from buying the excess produced at the top. This was actually one of the hallmarks of the Great Depression.

Thirdly, there is usually a shift in the labor force that depresses wages or other factor that lowers purchasing power. The following article is actually a great read with many examples of this.

The problems associated with inequality include recessions, social strife, political division, and in some cases violence and war. The late 19th century and early 20th century saw interesting developments in the labor movement in the US with many unions forming and becoming more active as wealth inequality increased. The Homestead Strike in 1892 is an interesting example of the conflicts during this time. In this event, the Carnegie Steel Company hired the Pinkertons who opened fire on the striking workers in an attempt to put down the conflict.

In the particular example of the Homestead Strike, there were trials and the responsible parties were held to account. The ultimate outcome did little to change the real underlying problem of inequality however because our laws and system are not configured to address it. In fact, this particular event ultimately weakened the union leading to its eventual collapse.

Over the next 25 years inequality grew and set the stage for The Great Depression. Interestingly enough while the wealthy were taking large risks in the stock market during this time, a housing bubble was growing due to expansion in overleveraged home loans. When the stock market bubble collapsed, it was joined with a large negative demand shock that plunged the world into depression.

The asset bubbles that precipitated the great depression were irrational and driven by large excesses of capital in the hands of the wealthy while the poor were being increasingly squeezed financially. As the wealthy accumulated more money, they increasingly took on more risky and irrational investments in an effort to deploy it. In these circumstances, inequality led to a situation in which an asset bubble emerged, which is very much contrary to the workings of efficient, rational markets.

In addition to the asset bubble, inequality prevents the realization of comparative advantage. The benefits of trade are well studied and known, but rely on economic agents being able to produce and sell the thing in which they have the most advantage over their trade partners. If capital access is limited, then it is difficult if not impossible to discover a particular population’s comparative advantage. This is exactly what happens in the economy however.

The wealthy disproportionately invest in the wealthy, or speculatively invest in asset bubbles, resulting in the less privileged of society having less access to capital. With less access to capital these underprivileged groups of people are cutoff from resources that could lead to their comparative advantage. These market inefficiencies leave the benefits of trade unrealized.

Investment strategies that mitigate inequality are opportunities to bolster the comparative advantage of an economy. There may very well be the next Henry Ford, Steve Jobs or Alexander Bell in the very large part of the population that is undereducated and/or has poor access to capital. Proper investments are required to unlock this potential.

In the following study, researchers identify that although half of the US population resides in secondary markets, they only receive 20% of total investment dollars limiting this group’s access to these investments. This disproportionate distribution of investment money highlights the missed opportunities to build comparative advantage.

Some cities in this study did receive significant investment money even though they were secondary markets. Some of the factors identified in this study that enable these cities to receive capital are the presence of strong industry and professional networks as well as the presence of national research institutions. These two factors are somehow related in that strong networks within particular industries are valuable to researchers and research is valuable to the industries in creating new IP’s. It is in these interactions that comparative advantage is built.

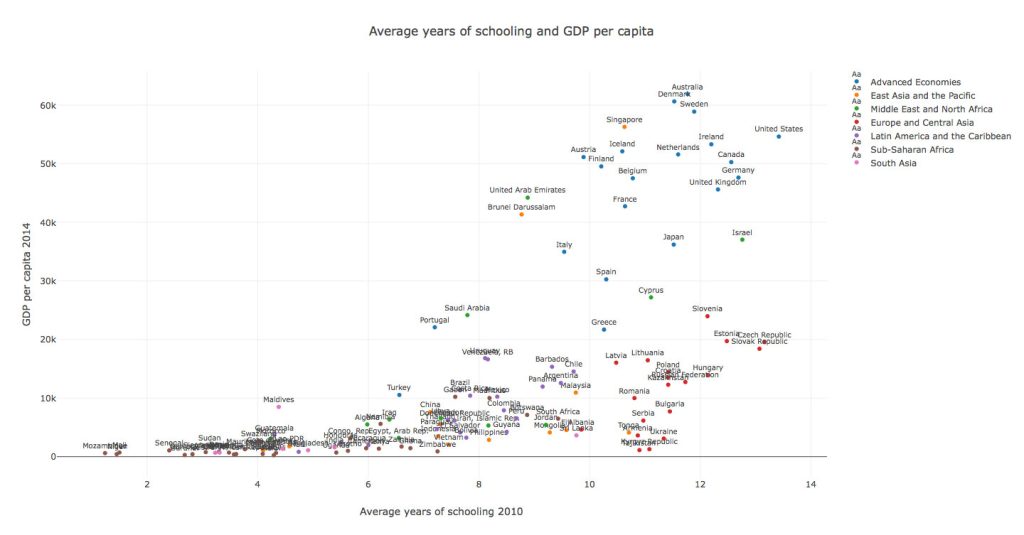

Below is a figure showing the relationship between GDP per capita and Education:

Although the connection shown in this chart does not indicate causation, when paired with the earlier cited works, it does highlight a compelling argument that investment in education would improve comparative advantage and help grow GDP by building the sorts of educational institutions and professional networks necessary to attract capital.

There are many studies that show the positive impact on GDP of investments in education and infrastructure. This is not the only benefit however. These kinds of investments also have the benefit of decreasing inequality as shown in the following two studies concerning infrastructure investment in South East Asia and education investments in Mexico.

- Infrastructure and Income Distribution in ASEAN-5: What are the Links?

- Investment in education, one of the key factors in inequality decline in Mexico

What is good for inequality is good for business. Investment into education and infrastructure not only reduces inequality, but it also provides lucrative investment opportunities for investors, which lead to overall economic growth.

By investing in solutions to inequality it is possible to create a scenario in which both the wealthy and the poor benefit. The wealthy reap the benefit of increased investment opportunities and a strong growing economy. The poor reap the benefit of better education, increased wages, and narrower income inequality. Both groups benefit from the increased social, economic and political stability.

Income Inequality is not an issue to be ignored. It is a signal that the economy is behaving inefficiently and an opportunity to adjust it. Comparative advantage can more easily be achieved by listening to this call. In the end, the winners are not the rich or the poor, but the whole economy. The collaborative efforts of Governments, the Private Sector and Individuals to reduce inequality have the effect of creating and growing more efficient economies.